In August 2022, the Inflation Reduction Act (IRA) was enacted, establishing a range of energy-related tax incentives that expanded upon the Investment Tax Credit (ITC). The Domestic Content Bonus Credit within the IRA increases the value of federal clean energy tax credits in the United States.

Manufacturing facility in Iowa Park, Texas.

These tax incentives were set to extend into the 2030s, but the One Big Beautiful Bill Act (OBBBA) of 2025 reduced or eliminated many of them. The OBBBA incentivizes and imposes strict rules on the use of domestic content. As a result, 2025 and 2026 will be important years for people and businesses looking to invest in solar panels, batteries and other clean energy products.

This blog will explain how the bonus works, the upcoming changes and how projects can still qualify for the domestic content bonus adder, specifically with the use of American-made balance of system (BOS) components.

How the Domestic Content Bonus Credit Works in 2025

If your project qualifies for the ITC, you can earn a bonus that increases the credit rate by 10%. For example, a 30% ITC can go up to 40% if specific rules are met. These rules mainly concern the use of domestic materials based on the relevant IRS notices.

Projects using American-made products can benefit from substantial tax incentives.

Shifting Guidance and Rising Expectations

The IRS has been gradually issuing guidance on domestic content, and each round has reshaped how developers and EPCs model projects.

In 2024, the elective safe harbor (Notice 2024-41) provided preset cost percentages for modules, racking, inverters and storage equipment. That simplified compliance modeling and gave investors more confidence.

The 2025 update (Notice 2025-08) refined those tables, separating rooftop and ground-mount PV and assigning extra value to modules built with U.S. wafers and cells.

The percentage of manufactured products that must be made in America also increases over time. It changes from 45% in 2025, to 50% in 2026 and then 55% in 2027.

Why It Matters for Developers and EPCs

Many project plans now include financial incentives in their analyses and pro formas because investors and lenders want to know whether a project qualifies before investing. Developers are deciding whether the extra cost of American-made equipment is worth the additional credits they can earn, often finding that the domestic content bonus is more valuable than a potential price increase.

Using American-made parts can help projects meet the required domestic content thresholds.

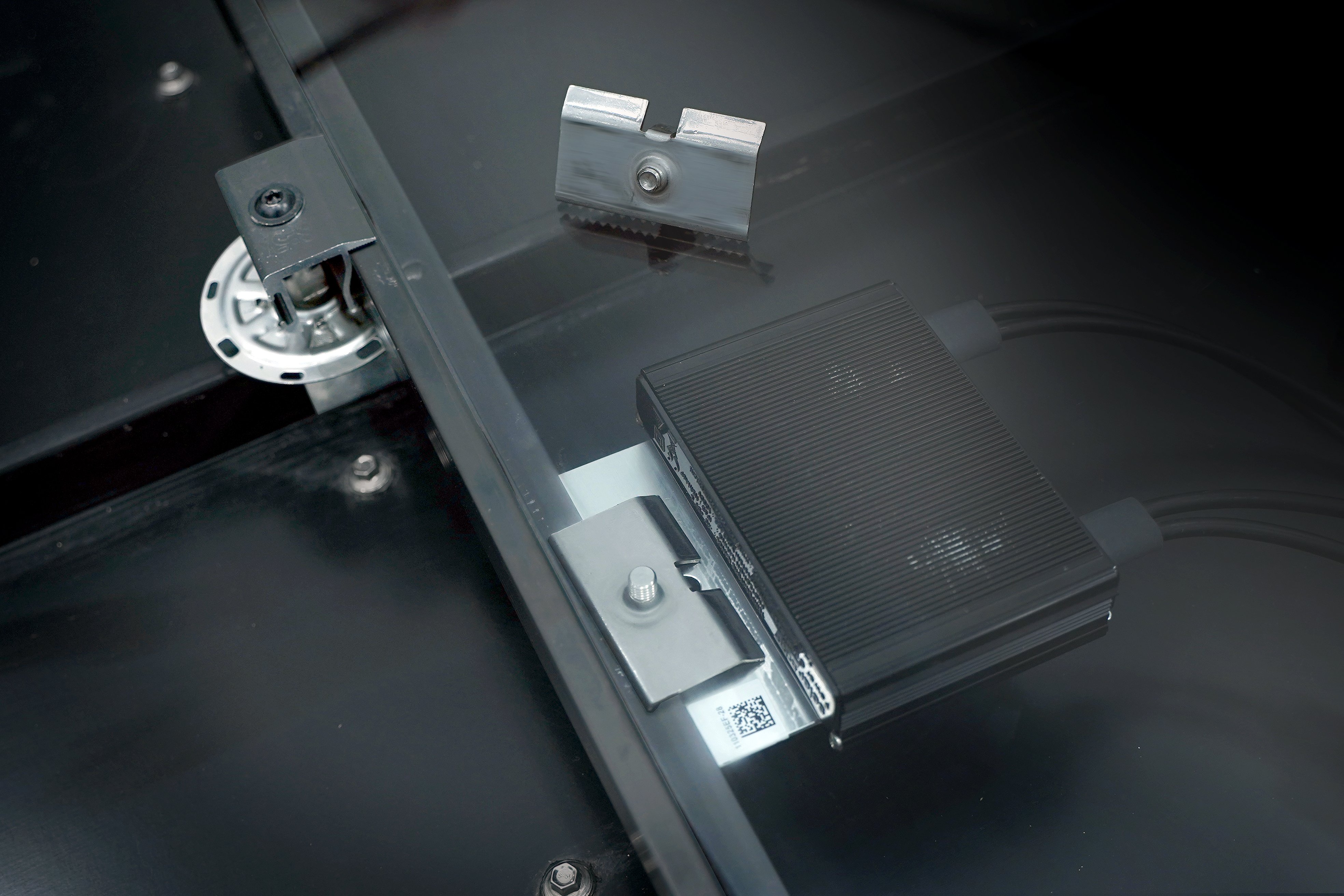

EPCs are changing the materials they use to focus on the parts that most influence compliance with domestic content rules, like solar modules, inverters, racking and module-level power electronics (MLPE). Even some BOS products, such as MLPE mounts, now play a key role in whether a project passes the requirements.

Ideas To Hold on To

The Domestic Content Bonus is an important part of the IRA and can have a substantial impact on qualifying projects. For manufacturers, these rules mean they need to provide more products made in the USA. MLPE mounts and other components, like S-5! PVKIT mounting gear, can help companies demonstrate compliance with domestic content requirements, which can be the difference between winning or losing a bid by using American-made products.